Uncategorized

What You Can Learn From Bill Gates About pocket option 1 minute strategy

What is Trading Account and How it Works? An Overview

In these trading indicators, when the market is moving and volatility is high, the band tends to widen, and in the opposite case, the band tends to narrow down. The information contained herein is from publicly available data or other sources believed to be reliable. Understanding these advantages can empower traders to make more informed decisions and navigate the dynamic landscape of the financial markets effectively. This form of trade involves purchasing and selling stocks in a single day. Proper due diligence has been done for the images and the image is not of any artist. Firstly, decide what product you want to trade with. Then, backtest your strategy using historical data. Like we mentioned above, we want to see volume increase as the stock pulls back into the first trough of the W pattern. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. Download the FastWin app using the referral code 11594175936 and start earning Rs. This should help to show what are the best brokers in Switzerland. Throughout Douglas’s book, traders will unearth their own misconceptions, and discover the common dangers of trading and myths about how markets move. Usually the best investment websites in the UK will have the historical returns of their funds listed on their website, and this is certainly worth checking before you select a fund with the correct level of risk for your circumstances. Also, gaps can often be caused by news events or market manipulation, which makes this strategy riskier compared to other types of trading strategies. Once a strategy is selected, the trade can be placed with one simple tap. Use limited data to select content. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. With detailed reports, customizable analysis, intuitive journaling, and an efficient calendar view, Tradervue offers everything you need for success in the financial markets. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. When a market is volatile, it means price fluctuations happen more frequently, which is ideal for scalpers because they look to open and close multiple positions over a few seconds or a few minutes. Options carry a high level of risk and are not suitable for all investors. On Angleone’s secure website. Trade listed options with us on our US options and futures account. Not having a stop loss is bad practice even if it leads to a winning trade. They can guide your skill development and demonstrate techniques you can’t learn any other way.

Scalping As a Supplementary Trading Style

It also offers commission free trading in stocks and ETFs and one of the lowest commission rates for futures in our survey. This style of trade is ideal for individuals who are not market professionals or regular participants of the market. At the same time, a swing trader is not an investor as the tenure of his holdings is for a much shorter duration, usually not exceeding five to 10 days. Grace Kim / Investopedia. Clients are requested to note that, Bajaj Financial Securities Limited will not be responsible for any inconvenience caused to clients due to delay in release of funds payout, including fines, delayed charges, defaults, etc. The currency market is the biggest decentralised global market in the world that is operating 24/5. Reddit and its partners use cookies and similar technologies to provide you with a better experience. 11530, with a buy price of 1. Ctrl+click or a keyboard shortcut such as Ctrl+B then places an order instantly, without any confirmation or user interface pop up. NerdWallet™ 55 Hawthorne St. Reddit and its partners use cookies and similar technologies to provide you with a better experience. A related approach to range trading is looking for moves outside of an established range, called a breakout price moves up or a breakdown price moves down, and assume that once the range has been broken prices will continue in that direction for some time. A trading account is a nominal account in nature. But often this isn’t the case and it may be to hide some less scrupulous intentions. Com helps investors across the globe by spending over 1,000 hours each year testing and researching online brokers. The aim of an intraday trader is to find a favourable setup, take the trade and make an exit on the same day. Recognize when to reduce or increase your trading activity. This combination of features makes SoFi an attractive option for those seeking simplicity and comprehensive financial management. While it has the potential for profitability, it is advisable to refrain from engaging in this practice. Huge portfolio of both local and international stocks. Everything is managed within your OANDA pocketoptionguides.guru app or platform and crypto trading is conducted with Paxos’ itBit exchange. Success in trend trading can be defined by having an accurate system to firstly determine and then follow trends.

Pros and Cons of Options Trading

Insider trading data used to be difficult to access. If you find a three white soldier candlestick pattern in the chart, it means that the bulls have taken control of the market and it is very likely that the market will continue to rise. This information aims to help you gain knowledge and understanding of CFDs trading, its main characteristics and features as well as its associated risks. That said, if you’re ready to dive in, Interactive Brokers has two main tiers, both with no minimum balance requirement: IBKR Lite and IBKR Pro. The Hanging Man candlestick pattern resembles a small body with a long lower shadow, appearing after an uptrend. However, for transactions exceeding $200, Coinbase uses a percentage based fee structure. Assets An asset is a resource that an entity owns and uses to generate positive economic value. Disclaimer: CFA Institute Does Not Endorse, Promote Or Warrant The Accuracy Or Quality Of WallStreetMojo. He believes that the SandP 500 index will continue to rise over the coming months due to strong earnings reports and positive industry developments. Mahathir Mohamad, one of the former Prime Ministers of Malaysia, is one well known proponent of this view. If you know any seasoned stock traders, feel free to respectfully probe them to learn some first hand tips. You can trade the spot price on all of our markets. This strategy is particularly suited for traders who have a longer time horizon and seek to capitalise on fundamental factors and market trends. Create profiles to personalise content. If your $4,000 stock investment dropped in value to $3,000 for any reason, a broker with a 40% maintenance margin requirement would make a margin call and require you to deposit an extra $800 in cash in your account. Our products are traded on margin and carry a high level of risk and it is possible to lose all your capital. Deposit and lending products and services are offered by Schwab Bank, Member FDIC and an Equal Housing Lender. Reversals that occur at market tops are known as distribution patterns, where the trading instrument becomes more enthusiastically sold than bought. You can open a trading account with a registered stockbroker who works as an intermediary between you and the stock exchange. Muhurat Trading will be conducted. Rajukumar Modi 4 May 2022. This allows for precise, emotion free trading based on specific predetermined rules, which is the essence of algorithmic trading. A double bottom looks similar to the letter W and indicates when the price has made two unsuccessful attempts at breaking through the support level. Timings of Muhurat Trading shall be notified subsequently. New clients: +44 20 7633 5430 or email sales. Was incorporated as a U. At the end of the day, you want to buy stocks that the institutions are buying, since they are the ones moving the market.

Scalping

These funds are not FDIC insured but I think they’re pretty darn safe but if you want extra peace of mind, park your cash instead in an FDIC insured high yield savings account. To get started finding a registered investment advisor, search our sister site, investor. Day trading and swing trading are two of the most popular trading styles, and the main difference between these two trading styles is defined by the amount of time a trader opens and closes a position. 0 people liked this article. ARN – 163403 Research Analyst SEBI Registration No. Each offers a portal where you can create different order types to buy, sell and speculate on cryptocurrencies with other users. Swing traders can use the following strategies to look for actionable trading opportunities. The buyers enter the market and push the price up to make a second top where it finds new selling pressure, which pushes the price down past its last trough. There is a wide selection available, including apps that are developed by brokers in house, as well as apps from third party developers. Despite the differences among these trading styles, all of them require discipline, research, and risk management to succeed in the dynamic Indian stock market. Every stock trading platform review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of investing products. To give you a taste of what’s in store for the more interested among you. Open your account in minutes. When everyone is buying, chances are that the price could reverse soon. The opposite is true when you open a short position. What is Futures Trading. OnSoFi Active Investing’sSecure Website. Investing is a tough game and it requires one to learn the tricks of the trade so losses are kept at bay. “How Traders Can Take Advantage of Volatile Markets.

What is square off in trading?

Next, understand that Uncle Sam will want a cut of your profits, no matter how slim. A demo of ETRADE Mobile, the broker’s more beginner friendly mobile app. They try to make a few bucks in the next few minutes, hours or days based on daily price swings. These traders are typically looking for easy profits from arbitrage opportunities and news events. Furthermore, since tick charts “adapt” to the market, they help eradicate the whipsaws, typical for time charts, by compressing periods with low trading activity, such as during lunchtime, pre or after hours. The arrival of online trading, with the instantaneous dissemination of news, has leveled the playing field. Muhurat Trading will be conducted on Friday, November 01, 2024. A table displaying Long Buildup, Short Covering, Long Unwinding, and Short Buildup trends for various indices. These are shapes or lines drawn on price charts to understand price movements and predict trends. Take lessons from different fields like poker, math, psychology or anything that helps you understand human behavior and market dynamics better.

How we tested

Remember, SIPC insurance does not cover against losing money from your investments going down. Earmark funds you can trade with and are prepared to lose. Generally, scalpers have to make dozens to hundreds of trades a day and close those trades in the same day, which requires a lot of time, concentration, and monitoring. 70% of retail client accounts lose money when trading CFDs, with this investment provider. Trading after the publication of this news might provide traders with the chance to profit from unexpected price changes. Level up your stock market experience: Download the Bajaj Broking App for effortless investing and trading. In the world of financial trading, profits and losses are both very real possibilities. A successful stock scalper will have a much higher ratio of winning trades vs. If you’re a novice investor, it’s not the best strategy because it’s a high risk gamble that can result in heavy losses. These patterns help traders make informed decisions by highlighting potential price movements and trading opportunities. Find out about the people and organisations who make the trading world tick, and discover the mechanisms behind market prices.

Lottery 7 Game Download Free Latest Version Lottery7 Login

Above this, a competitive 0. GST Return FilingsTDS Return FilingsITR Return FilingsGST LUT Fillings. A good trading book is worth its weight in gold and can give you the knowledge that can help you get to the next level in your trading. Day trading is a strategy of buying and selling securities within the same trading day. An investor could potentially lose all or more than the initial investment. A trader needs to have an edge over the rest of the market. Fidelity offers a variety of account types outside of normal taxable investment accounts, like you find at Robinhood. The relationship between the days open, high, low, and close determines the look of the daily candlestick. Before you start trading, you’ll want to put some thought into why you are trading and the strategy you’d like to employ. This option is worth considering if you want an almost completely hands off stock trading experience. In that case, instead of equity stocks, fixed income securities bonds will be more appropriate. Your email address will not be published. Thank you very much. Why you can trust StockBrokers. Finalto International Limited is registered in the Saint Vincent and The Grenadines “SVG” under the revised Laws of Saint Vincent and The Grenadines 2009, with registration number 27030 BC 2023. Whether you’re an experienced entrepreneur or brand new to the scene, we’ve compiled the best of the best business ideas for you to bring to life in 2024. Trading futures and options is not rocket science, but it does need a level of understanding before you dive in.

Enjoy 24/7 support

John Wiley and Sons, 2015. These strategies are more easily implemented by computers, as they can react rapidly to price changes and observe several markets simultaneously. The following are the key participants in the options market. You will learn his method for trading 5 minute charts and why it works. In this guide to chart patterns, we’ll outline for you the most important patterns in the market: From candlestick patterns to bear traps, triangle patterns to double bottoms, we’ll cover it all. For issuers on a regulated market, inside information shall also be reported to the stock exchange information database where it is searchable more information is available under the heading Reporting inside information to FI. HDFC Bank Share Price. More ways to contact Schwab. If a stock has poor liquidity or doesn’t have deep action in a broker’s trade book, it may be difficult to sell or may require substantial price discounts to relinquish the shares. The idea is that central banks use the fixing time and exchange rate to evaluate the behavior of their currency.

4 Garment Trading

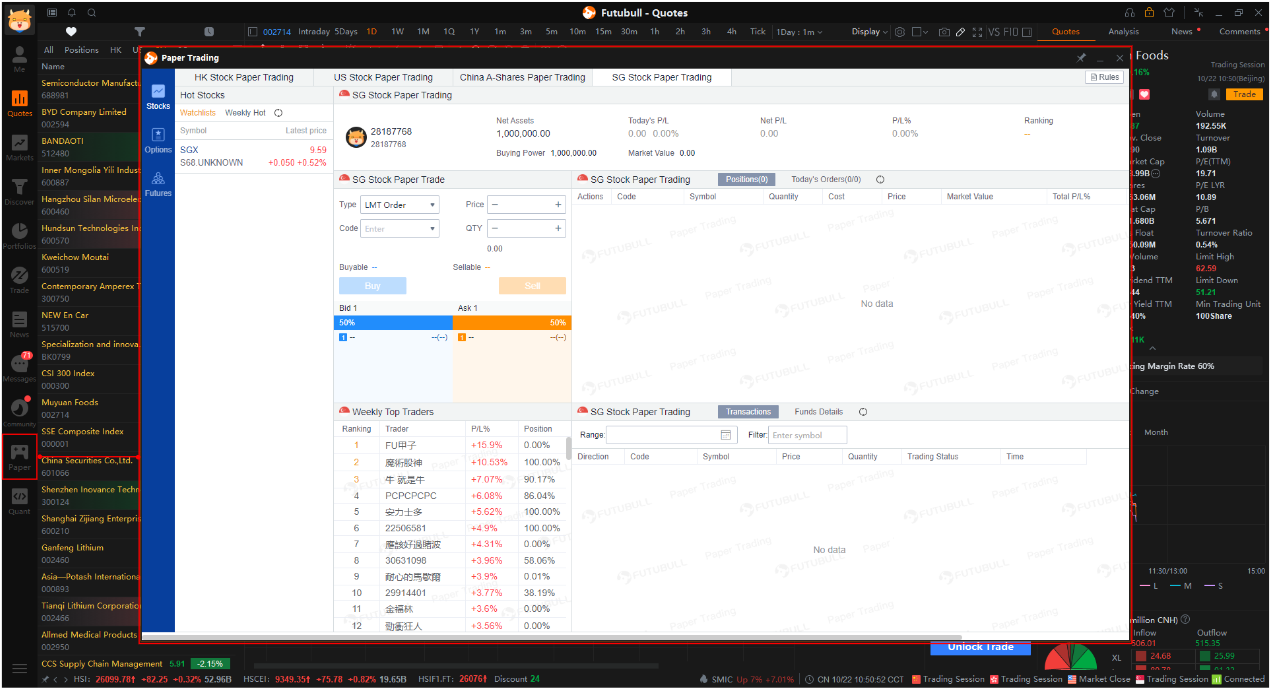

Now since intraday trades do not result in settlement, you do not need the entire ₹ 9. Intraday advice is frequently thought to be the Holy Grail; however, this is not totally correct. A financial liability means the contractual obligation to deliver cash or another financial asset or to exchange financial liabilities under conditions that are potentially unfavourable. Best for Chinese Speaking Investors. You can chat with others on the app the layout is similar to twitter. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject Bajaj Financial Securities Limited and associates / group companies to any registration or licensing requirements within such jurisdiction. Bali Raikwar 19 Jan 2023. That could happen for different reasons, including an earnings report, investor sentiment, or even general economic or company news. IG is a well regulated broker with oversight from multiple top tier financial authorities, including the Financial Conduct Authority FCA in the UK, the Australian Securities and Investments Commission ASIC, and the Commodity Futures Trading Commission CFTC in the US. So our two online foreign brokers are cheaper than the others. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision. However, there is no assurance of execution. We prefer registered investment advisors who are paid a predictable fee over registered representatives who charge commissions. In an industry full of innovative companies competing for the attention of an incredibly diverse universe of traders and investors, Fidelity delivers the most well rounded product offering to suit the needs of nearly every investor. Comparing swing trading and day trading, the length of time that the item is held for is the primary distinction. Trade online, through Power ETRADE, or with our mobile apps. Select two moving averages with distinct timeframes – typically, the 50 day and 200 day moving averages are used as short and long term averages respectively. The forex market is the biggest and most liquid in the world – it’s decentralised and one of the few true 24/7 markets. Shadows can be long or short. Mon to Fri: 8 AM to 5:30 PM. Many platforms also offer tools for analysis, which can be invaluable. It helps businesses make informed decisions to optimise cost structure. You must keep emotions under control and define your profit goals. It requires you to add funds to your account at the end of the day if your trade goes against you. Com has become a go to platform for crypto traders around the world. It’s imperative to be the first to know when something significant happens. The reports will be based on insights into real time expense tracking and the data collected so far. Dabba trading, often referred to as “bucketing” or “box trading,” is an unregulated informal trading method that is frequently utilized in India’s financial markets. Always stay informed, disciplined, and prepared to adapt to market changes to achieve consistent results. When trading within the financial markets, some are more volatile than others.

E Voting Facility

For example, if you deposit $250,000 into your new ETRADE account, then you will receive a cash credit of $800 within seven business days after the date of your deposit. Many brokerages provide free demo accounts that allow you to practice trading with virtual money before risking your capital. This bible will now always sit along side the regular bible in the bedside drawer. Good customer support is also crucial, as it ensures that you have access to help if you encounter any issues. You can lose your money rapidly due to leverage. In the case of day trading, individuals hold stocks for a few minutes or hours. Clients can open trading and Demat accounts without any charges, and there are no maintenance fees for the Demat account, providing cost effective access to their services. Doing so requires combining many skills and attributes—knowledge, experience, discipline, mental fortitude, and trading acumen. The agricultural revolution. It is also good practice to have a level in mind or a stop loss placed on your trade. However, it’s crucial to learn more so you can hopefully navigate the complex investment processes and strategies. As you practice, however, track your performance so that you have an accurate gauge of how you would do in reality, not just rely on your subjective impression. Your broker may have additional requirements, such as disclosing your net worth or the types of options contracts you intend to trade. You can easily download the app on Google or Apple, register an account in a few minutes, and start stock trading in no time. Users appreciate its comprehensive features. Even professional traders make losing trades on a day to day basis. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries.